Stablecoin Dynamics

Discussing the role of stablecoins now and later

Stablecoins have become indispensable instruments in the crypto ecosystem, merging fiat stability with blockchain’s intrinsic efficiency. Their proliferation underscores their strategic utility in facilitating liquidity management, arbitrage strategies, and hedging against market volatility. This essay delivers an advanced analysis of stablecoin dynamics, focusing on nuanced market behavior, transactional analytics, and the future.

Investor Holding Patterns and Smart Money Behavior

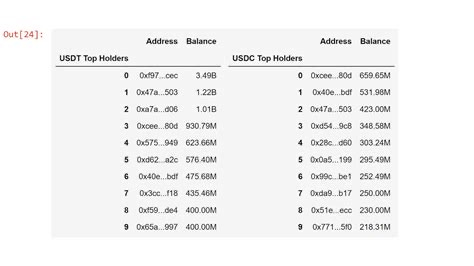

Advanced wallet analytics from Dune’s "Top Holder Analysis" dashboard underscore concentrated holdings within institutional wallets. Approximately 45% of USDC supply resides in wallets exceeding $1 million holdings. Such concentration introduces systemic considerations, including market manipulation risks and liquidity shocks during substantial redemptions. Additionally, Dune’s "Smart Money Watch" dashboard reveals strategic accumulation behaviors preceding market downturns, demonstrating sophisticated investor strategies aimed at capitalizing on distressed asset valuations.

These top wallets are often deeply integrated with other protocols (e.g., lending platforms like Aave or Compound). If one of them becomes insolvent, hacked, or chooses to rapidly withdraw, the cascade effect can impact multiple protocols—leading to a “DeFi contagion.” The Terra-LUNA collapse in 2022 showed how reliance on a few large participants (and poorly collateralized systems) can unravel an entire ecosystem. Such holdings, when dormant, create the illusion of deep liquidity, but in times of volatility, the rapid exit of just a few of these top holders can cause major dislocations in lending markets, liquidity pools, and even stablecoin pegs. Stablecoins depend on consistent supply-demand equilibrium. If that balance is suddenly distorted by coordinated or large-scale redemptions, downstream impacts ripple across protocols that rely on those stablecoins as collateral or for liquidity provisioning.

Further examination of investor holding patterns indicates distinct behaviors among different holder categories. Smaller retail investors typically utilize stablecoins primarily for transactional purposes, demonstrating higher turnover rates and smaller balances. In contrast, institutional and high-net-worth investors maintain significantly larger balances over extended periods, suggesting strategic reserves intended for leveraging market opportunities. This bifurcation in investor behaviors reflects divergent strategies tied to distinct financial objectives and risk tolerances. Sophisticated players tend to front-run market cycles—parking capital in stablecoins ahead of anticipated downturns, then rotating into risk-on assets at cycle lows. This capital rotation pattern, when traced over time, provides predictive utility for sentiment analysis and asset flows. Importantly, it also reinforces the role of stablecoins as the preferred vehicle for institutional dry powder.

Too Big To Fail?

Regulatory frameworks worldwide are increasingly focusing on stablecoins due to concerns around financial stability, consumer protection, and potential systemic risks. For instance, the European Union’s Markets in Crypto-assets Regulation (MiCA), introduced in 2023, explicitly targets stablecoin issuers, mandating robust transparency and stringent reserve requirements. Similarly, in the United States, proposed legislative measures such as the Stablecoin TRUST Act emphasize mandatory audits, reserve disclosures, and oversight by regulatory bodies like the Federal Reserve and the Office of the Comptroller of the Currency (OCC). Conversely, regions with ambiguous or overly restrictive regulations have witnessed migration of capital and innovation to more favorable jurisdictions. Evidence indicates regions with clearer regulatory guidelines, such as Singapore and Switzerland, are becoming hubs for stablecoin and broader crypto innovation.

Stablecoins, especially those pegged to major fiat currencies like the U.S. dollar, can reduce central banks’ control over monetary policy. If large portions of an economy operate using privately issued digital dollars (e.g., USDC or USDT), central banks may find it harder to implement tools like interest rate changes or money supply adjustments. This becomes even more complex if stablecoins are adopted across borders. EtherFi is evolving into a neo-bank driven by restaking. 3.7% is being paid by PYUSD. Stablecoin checkout rails are being added by Stripe. Stables are being targeted by small businesses as a way to avoid paying 1.6–3% in processing costs. Stablecoins are launching an offensive in this impending margin war.

Only nine stablecoins have crossed the billion-dollar mark in market cap—a drop in the bucket next to the $18 trillion M1 money supply, but enough to signal their arrival as systemically relevant players. What’s more striking is that every one of these top-tier projects is either fully centralized or barreling toward it, with structures so formal you could call up a front desk and place an order. The roster ranges from legacy leaders like USDT and USDC to incumbents like BlackRock and PayPal reinventing themselves onchain, to former DeFi darlings like Sky and Ethena now prioritizing institutional capital over decentralization. The tide has turned. Regulatory stalling tactics might buy time, but they won’t reverse the momentum—stablecoins have hit escape velocity, and Wall Street’s embrace ensures they’re not going anywhere. The past year didn’t just shift the narrative; it cemented a new chapter.

The Future of Stables

Stablecoins are evolving far beyond their original use case as simple dollar-pegged digital assets. One of the most overlooked opportunities lies in their ability to serve as programmable tools for automating business-to-business (B2B) operations. The real friction in cross-border payments isn’t necessarily due to slow financial infrastructure, but rather a result of broken and disjointed workflows. Issues such as tax reconciliation, invoice validation, and localized KYC compliance create substantial delays and inefficiencies. Companies like Loop, Nickel, and Stripe through its Bridge.xyz project are developing orchestration layers that address these problems. The firms that successfully integrate stablecoin payments with seamless automation will likely shape the future of global B2B transactions.

The traditional model for stablecoins was fairly straightforward: back the token with cash reserves, peg it to the U.S. dollar, and release it into the market. However, this old playbook is rapidly being replaced. The next generation of stablecoins is being built with a much broader scope in mind. They’re being designed to interact with emerging trends such as airdrop farming and incentive layering, supporting experimental economic models like point-based gamification. They’re also being developed to integrate with AI agent marketplaces and to serve as modular tools for foreign exchange operations. Beyond that, they’re increasingly being positioned to handle complex international B2B payment flows and even to serve as a payment method in everyday retail settings.

What’s striking is that most of this evolution is still happening quietly. Despite the increasing sophistication of stablecoin infrastructure, we haven’t yet seen true mass adoption or widespread real-world use. Yet, the building blocks are already in place, and many of them are functioning effectively in live environments. The groundwork is being laid for stablecoins to play a much more significant role in global finance than they do today. Centralized stablecoins will eventually find their footing through regulation and public discourse, but in the meantime, decentralized issuers are poised to enjoy a renewed surge in activity—even if stablecoin legislation stays stagnant.

Yield Farming Ops

I want to write a more in depth about yield farming opportunities right now and how I believe they are going to gain a lot more traction and possibly a new narrative in the coming months. But for now I will graze over what I’ve been farming and looking at. Pendle allows you to lock in a fixed yield on-chain through PT-csUSDL, offering a DeFi-native alternative to traditional bonds. By purchasing csUSDL Principal Tokens, you convert variable yield into a stable, guaranteed return—currently around 12% APY—paid directly in stablecoins. This means no price volatility, no fluctuating rewards, and a clear, predictable income stream, all without relying on real-world banks. A in-depth write up of Pendle should be on its way. I still think it is one of the most undervalued projects in crypto.

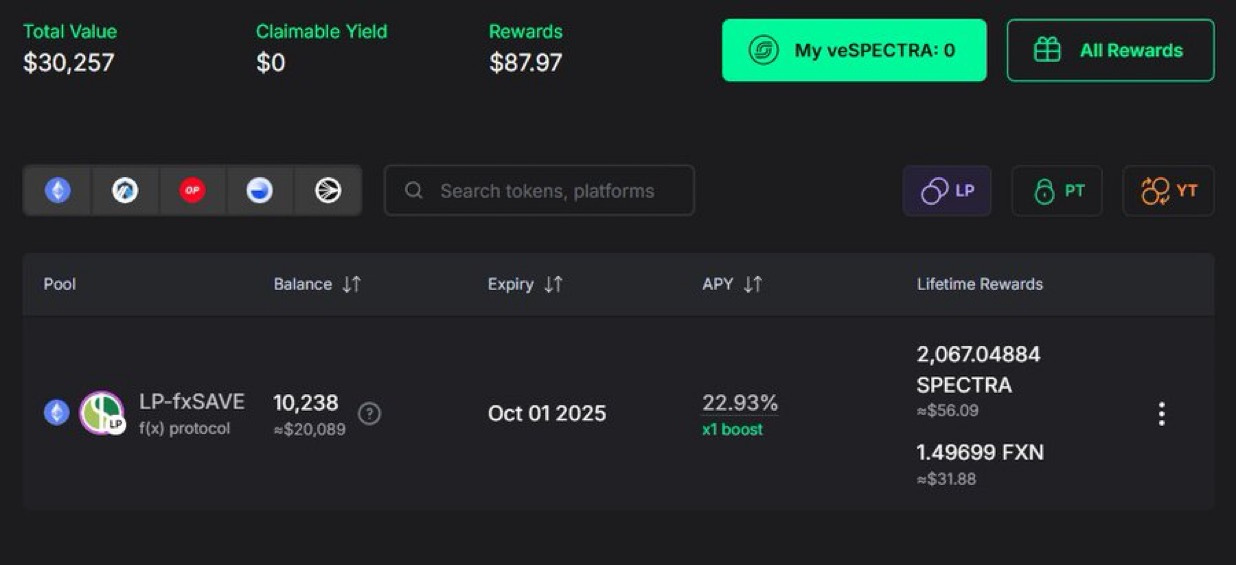

Mantle’s $MNT Launchpool has been delivering impressive returns, averaging nearly 60% APR since its inception. Recent pools like DOLO and ZORA offered yields of 28% and 56% APR, respectively. For those confident in the upside of $MNT, naked farming is an option. Alternatively, if you prefer a more hedged approach, delta-neutral strategies let you earn around 10% on your short while minimizing exposure to price swings. Another one you may want to look at is Protocol Fx and Spectra Finance. The fxSAVE LP is currently earning a solid 23% APR on Spectra, even without any boost, with rewards paid in SPECTRA and FXN. fxSAVE serves as the receipt token for the fxUSD stability pool, and despite flying under the radar, it’s been delivering consistently strong yields. It’s a surprisingly good option—especially for smaller players, as it’s not really built for whales.

The implications of stablecoins go far beyond the crypto niche. Their growing popularity signals a foundational shift in how we think about money, sovereignty, and financial architecture. The challenge will be balancing innovation, inclusion, and efficiency with stability, privacy, and regulation. The world is not just watching stablecoins—it’s being shaped by them.